|

In 2024, each month a member of our team is offering up "Team Words"--a phrase that is meaningful to them that they'd like to share with our team. We are sharing some of them on our blog with all of you. This month's selection comes from Julian Becker, Senior Portfolio & Data Manager at High Impact While the sentiment in this quote of following one’s passions is not necessarily unique and can even be seen as cliché, I read this book during a period of significant personal and professional changes in my life, and its phrasing deeply resonated with me. My education in business and economics had largely trained me to make choices based on what I was best at, or my "Competitive/Comparative Advantage." This mindset helped me optimize metrics that an economist or business analyst might consider proxies for a good life (raises, promotions, and prestige).

However, focusing on these external factors led me to build a life I wasn’t necessarily passionate about. I had been neglecting many of my passions, including my desire to do work that has a positive impact on the world. Although my job at the time was interesting and involved amazing co-workers, it primarily benefited a small group of “Ultra-High-Net-Worth” families. Fortunately, one of my undergraduate professors introduced me to the world of impact investing and Community Development Financial Institutions. This exposure helped me pivot to an industry where I can do work that I am good at and feel passionate about. The quote ringing around in my head also motivated me to start pursuing more of my creative passions in my non-work life, passions I had largely ignored since high school because I had labeled them as “unproductive.”

0 Comments

This blog is the second of a series of four highlighting our core values: social impact, empathy and support, being solutions-oriented, and everyone has a seat at the table.

You are working with a prospective borrower to try to help support their project building affordable housing, or employing people with disabilities, or securing a new facility for a school, and as you proceed, you hit a roadblock. Maybe it’s a lack of liquidity, maybe it’s a low value in an appraisal, or maybe it is escalating construction costs. What do you do? Well, if you want to take a page out of High Impact’s playbook, you roll up your sleeves and take a solutions-oriented approach to find the path forward. Being solutions-oriented is a core value for High Impact because it characterizes how we approach all of our interactions—with clients, with their borrowers, and with each other internally. Rather than just identifying a problem, we want to also come forward with a solution, or at least with an attitude that is open to and supportive of finding a solution together. We are in a sector of the finance industry that is full of difficult and non-standard deals—and therefore we need to be excellent at finding solutions throughout our lines of business to be successful. Similarly, as a growing business, we naturally run into challenges at times. A solutions-oriented mindset is critical to overcoming them. And as a client-services business, we need to be willing to be flexible and creative to help our clients succeed. While being solutions-oriented is a highly prized value in our firm, it does not mean being willing to take on too much, continually circumventing well-founded processes, or routinely working long days or weekends. Those types of solutions are a short-term fix that will only serve to compound problems in the future. Instead, we want big picture solutions that make our work run smoothly in the long term for our clients, their borrowers, and our staff. That’s what we are all working toward together. There’s an old saying that the best time to plant a tree was 30 years ago—the next best time is today. Similarly, the best time to start taking data seriously is long ago—but the next best time is today. If you are in the position of recognizing the inevitability of good data usage as a prerequisite for competitiveness in the future, and yet you know you do not have sound data policies in place today, the best thing you can do is get started on your data journey today. Here are three key steps that we recommend as you get started. 1. Evaluate and prioritize data points for collection. There is an endless amount of data that you could endeavor to track—a real estate lender might track loans originated, housing units created, risk rating changes, jobs created, per unit development costs, guarantor liquidity, and on and on. To avoid the paralysis that comes with an overly ambitious list, take the time upfront to consider what data would be most impactful for you as an organization, and to prioritize that data for collection. Perhaps you want to focus on data that helps tell your impact story, or data that would help you make better underwriting decisions. By doing this, you will generate a shorter list of critical data with a clear objective—thereby increasing you and your organization’s motivation and ability to carry out the data collection effort. It is absolutely true that by focusing on certain data points today, you may end up having to double back to collect data from the same sources in the future. That outcome is far better than the likely alternative, though, which is to seek to collect all potentially useful data starting now, only to burn out in two months with an incomplete data set when attention gets redirected or motivation wanes.

2. Start going backward and forward. To generate a useful data set as quickly as possible, start gathering data from historical sources (old credit memos, reporting that borrowers have submitted in the past, etc.) while also setting up internal protocols for collection of data generated by new events (new approvals, next quarter’s reporting cycle, etc.). By doing this, you will have a ready set of data that can be analyzed quickly, yielding the positive feedback that you and your staff need to sustain motivation and really visualize the benefit that rigorous data collection can bring—actionable data that can help you make better decisions. 3. Implement a periodic review cycle to ensure data completeness. A data set is only as good as its inputs. Missing, wrongly formatted, or inaccurate data can cause errors in calculations, distort results, and degrade confidence in analysis. To avoid this, one person should have responsibility to periodically review a given data set to ensure completeness and data hygiene. The timing of the review should be based on the frequency of data input and the ease with which accurate data can be obtained after the fact. Technical assistance hours, for example, should likely be checked weekly, because if they need to be backfilled any more than that, the person doing so is likely guessing. Information on the characteristics of approved loans, on the other hand, could be checked only quarterly, as the data needed for backfilling are held in credit memos that aren’t going anywhere. If you execute on this implementation plan, in a matter of months you may have a dataset worth analyzing. Once your colleagues start seeing that you value using the data they are collecting, and you can share with them analytical results from that data, momentum should build further. If you execute on this implementation plan, in a matter of months you may have a dataset worth analyzing. Once your colleagues start seeing that you value using the data they are collecting, and you can share with them analytical results from that data, momentum should build further. From there, the limits of your data usage will only expand in front of you. So, plant your data tree today—there is no better time. Peter Schaeffing, President

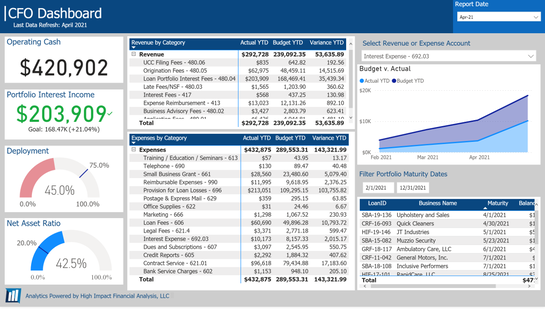

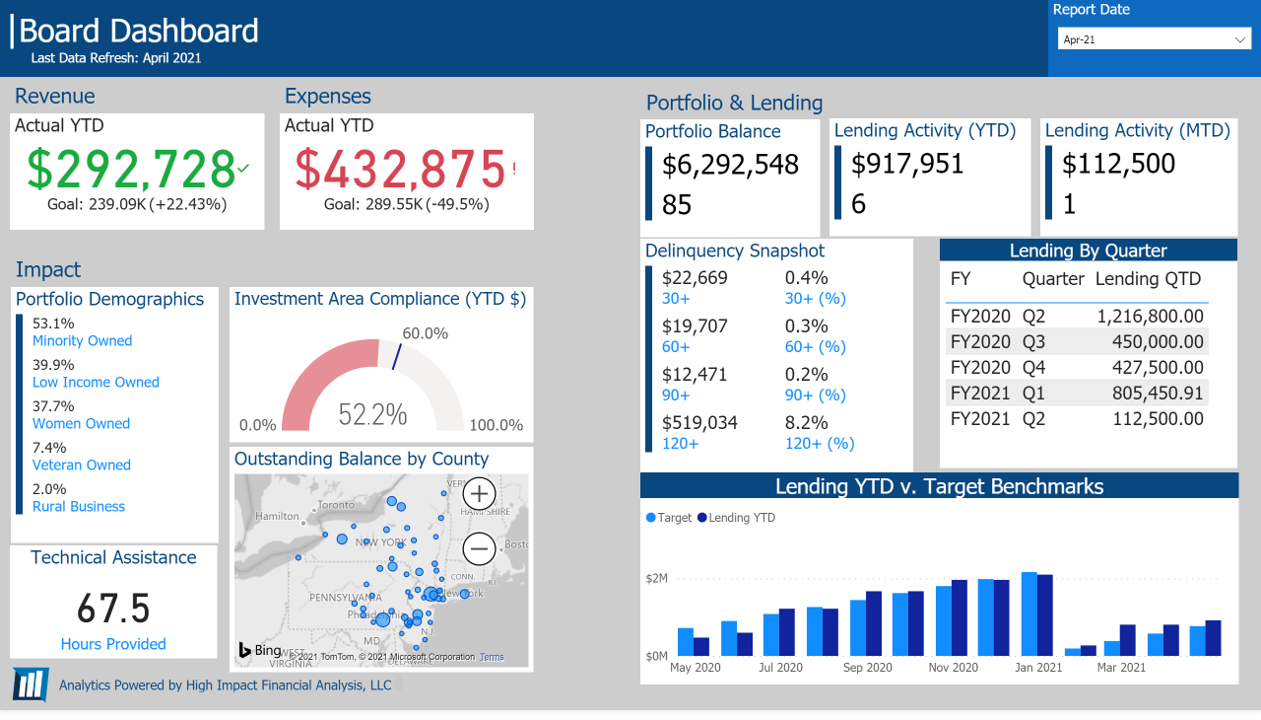

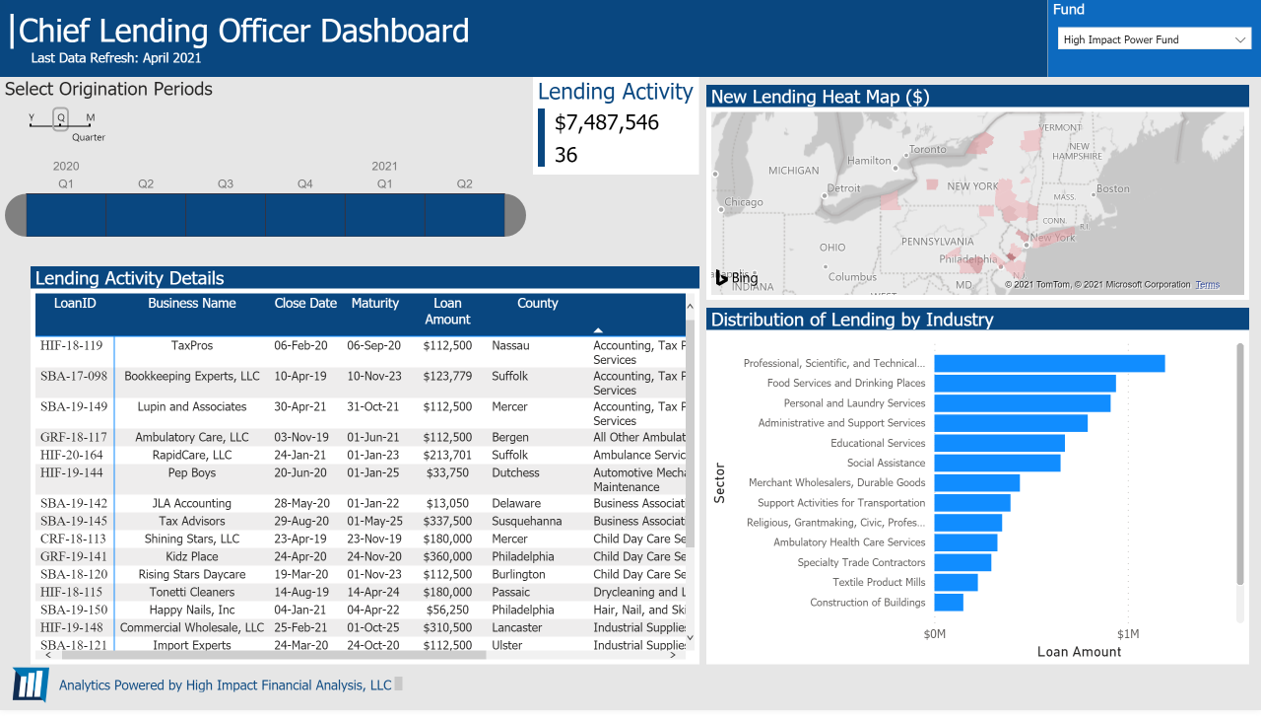

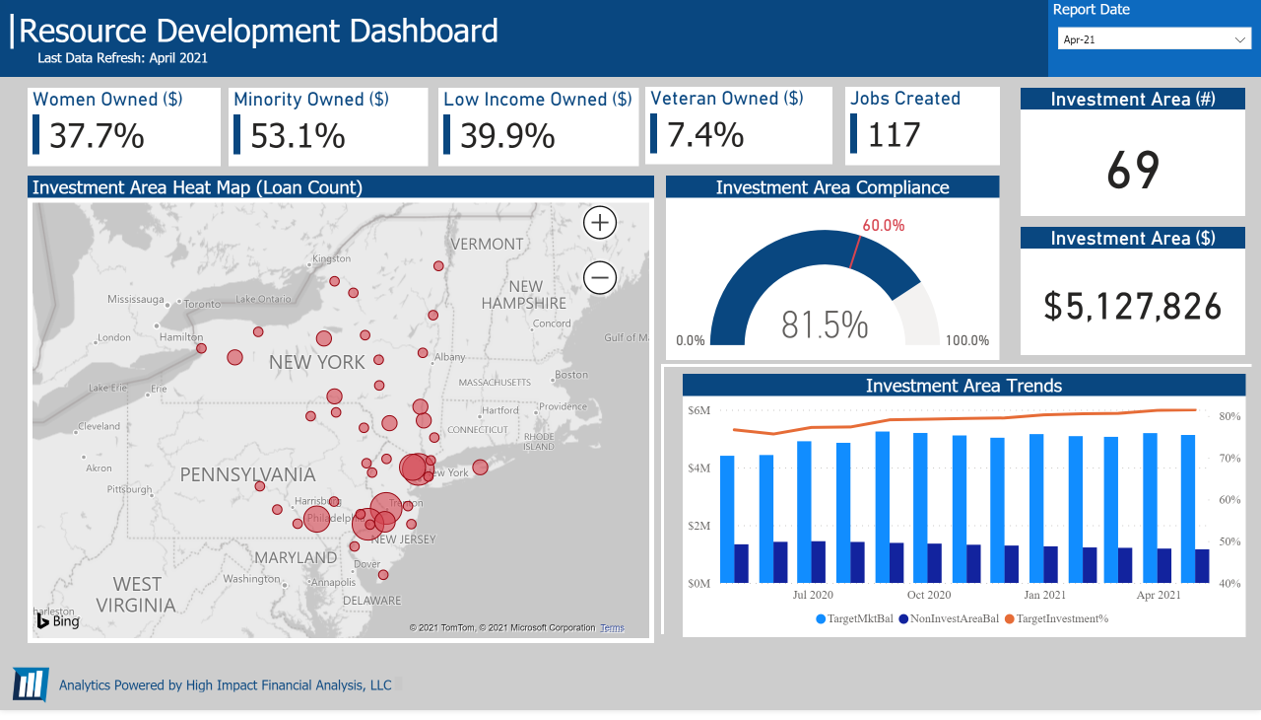

During Black History Month, we appreciate the progress made and the long journey ahead toward racial equity and the destruction of structural racism. Being involved in lending, we have a front-row seat to some of the hallmarks of structural racism. The concept of CDFIs originated in large part due to the economic exclusion of minorities from mainstream financial institutions and, through the pernicious and institutionalized practice of redlining, particularly from the mortgage market. In the present day, many of our clients now have successful programs supporting BIPOC developers as a direct response to the same issues. The necessity of these programs is, indeed, the legacy of redlining—for many Black developers, their network of family and friends have been blocked from building up the wealth and available capital needed to kickstart a career in real estate development. We commend our many clients, past and present, who recognize that need and are pursuing it rigorously—from Philadelphia Accelerator Fund, to the Leviticus 25:23 Alternative Fund, to Capital Impact Partners, Low Income Investment Fund, and LISC Fund Management. There is much work to be done, and many of our clients are boldly leading the way. We hope that this month offers the opportunity for our staff, clients, and partners to reflect on where we are, think about—and really deeply contemplate—how recently segregation and assassinations of Civil Rights leaders were the news of the day, and consider how we can aggressively move the ball forward now. My hope is that by the time I retire, we are not still working on programs supporting BIPOC developers—because by then, the need will have been met by the mainstream capital markets. For that to happen, we can’t lose our focus on this critical issue today, even as more years separate us from the jolt of action and infusions of capital that resulted from the tragic murder of George Floyd. We have to keep doing whatever we can to support projects by Black developers who are motivated by mission and who lack only the capital to impact our lowest-income and most under-resourced communities in a way that will reverberate for generations. We pledge to continue to do what we can to support this important work. Dashboards provide critical insights through visual representations of key data and trends that are easy to interpret and direct focus to the most important information and takeaways. Effective dashboard packages utilize a combination of Summary and Supporting schedules. Summary dashboards focus on KPIs as well as key trends, ratios, and metrics, while supporting pages provide more granular insights and can leverage interactive features to support deeper analytics. For example, while a summary page might focus on total portfolio growth, supporting dashboards would include insights on the funds, products, and/or geographies driving that growth. So, what information should you include in a CDFI dashboard package? That depends on your audience. CDFIs have many different stakeholders—both internal and external—and they all need different information to meet their needs. Remember, information overload can be just as detrimental as a lack of information. Connecting stakeholders to the right information so they can act upon it is your primary goal in designing a dashboard package. This is where our High Impact Portfolio Analytics service shines. Once data modeling is complete, you have full control over which content your various audiences can access, and the data in the system can be used to create any number of targeted, interactive dashboards with specific audiences in mind. Here is our take on the top five dashboards that CDFIs need to ensure that the right data are available for the right stakeholders at all times.

#2: The Board Dashboard CDFI Boards of Directors are responsible for the overall strategy and oversight of the organization. Their needs are best met by monitoring the big-picture numbers and strategic direction. Adding in a taste of impact is critical.

#3: The Chief Lending Officer Dashboard Chief Lending Officers are often charged with both generating originations and ensuring that only good loans are made. An effective dashboard will keep an eye on both.

#4: The Resource Development Dashboard Staff focused on raising funds need to be able to effectively tell the impact story of the loan fund. Equipping them with clear, concise dashboards that communicate the success of the CDFI is critical.

By making these dashboards easy to access and update, all your critical internal and external stakeholders will have the information they need to make sound, confident decisions. High Impact configures and manages dashboards for CDFIs using our High Impact Portfolio Analytics Service in Microsoft Power BI. For more information, contact us at [email protected]. In 2024, the team at High Impact is taking turns sharing quotes that are meaningful to them. February's quote is a bold one from staff member Alex Vazquez, Portfolio Manager, care of Teddy Roosevelt: Here is Alex's explanation of what this quote means to him:

"I keep this quote close to me because it reminds me in my personal life that our efforts are what’s truly important. We cannot control outcomes nor what others have to say - but we can control our efforts. Life and especially our work can be discouraging because of not being able to see our impact in a way the moves the needle tremendously, but our efforts play a big part in moving the needle. Subconsciously, our efforts also give others permission to dare greatly as well. And together, we can move the needle of impact further than we can by ourselves!" We hope it inspires you to dare greatly, too. As we have grown from a one-person startup to a more mature 10-person company, High Impact’s growth has been made possible by our commitment to the concept of “everyone has a seat at the table.” At High Impact, “everyone has a seat at the table” is one of our four core values because we know that we will be stronger as a company if we hear everyone’s voice and insights. Embracing this principle fosters a culture of inclusivity, where diverse perspectives converge, creating a vibrant ecosystem of ideas and innovation. In such an environment, every team member, regardless of title or tenure, feels empowered to contribute, propelling the company towards ingenious solutions and fostering a sense (and a truth) of collective agency in the company's evolution.

For a company operating within an industry that cherishes bottom-up approaches as we do, this value becomes even more pivotal. It ensures that insights and viewpoints from every level are not only heard but are actively sought after and integrated into the decision-making process. Just as CDFIs and other impact lenders understand that solutions are most effective when they are arrived at collectively, we know that we will have our greatest impact by inviting contributions from all corners. This value not only enhances problem-solving capabilities but also cultivates a culture worth working in—it is a lot more interesting to dedicate your professional time to a company that wants to hear what you say, and often acts on what you say, than one that believes that all the wisdom lies with management. “Everyone has a seat at the table” has served us very well in our first 10 years, and I have no doubt the ethos will be with us as a company forever. When managing a portfolio, easily attainable information often draws attention away from more relevant and critical data. Too often, the tendency is to fixate on accessible details, such as guarantor financials, while overlooking the deeper, potentially harder to quantify indicators of primary repayment risk. Since many loan agreements require the guarantor to submit quarterly financials, spreading them and writing a quick update on changes in financial condition feels productive. And yet, the guarantor is the secondary, or in some cases even the tertiary, source of repayment—so clearly this approach is falling short of the ideal for proactive portfolio management. It is analogous to the continuing efforts on the impact measurement side of CDFIs to find ways to go beyond housing units produced, jobs retained, and other quantifiable indicators to get to true, lasting community impact.

For this reason, we advocate for a paradigm shift—a deliberate emphasis on scrutinizing the primary source of repayment over the easier to analyze secondary or tertiary sources of repayment. Our approach prioritizes a holistic assessment, rooted in monitoring risks identified during the initial underwriting and identifying new risks that emerge during the loan term. While it demands a more thoughtful approach, this methodology yields indispensable insights crucial for proactive portfolio management. By steering focus towards the most urgent and relevant risk factors, our methodology equips lenders with the information they need to truly manage their portfolio proactively. This deeper, more nuanced approach to portfolio management capitalizes on the insights gained during the underwriting process and maintains a pulse on evolving conditions to keep a clear view on actual credit risks. Yes, we still do spread guarantor financials and monitor for changes in financial condition, but we put the spotlight on more immediate indicators of risk. This allows our clients to adapt strategies, proactively consider restructuring needs, mitigate threats, and ultimately safeguard the health and stability of their portfolios while also positioning their borrowers for success. By embracing the challenge of diving deeper into underwriting insights and continuously monitoring for emergent risks, community development lenders position themselves not just to react but to anticipate, ensuring a resilient portfolio and the best chance for success for borrowers and lenders alike.  This year at High Impact, our team is sharing words of inspiration with each other. At the end of 2023 we gave each staff member a frame with the same inspirational saying in it--and each month this year, a different staff member will select a new phrase to be shipped out and put in these frames for the new month. It's a simple way to connect us all from our headquarters in Albany to the home offices of our remote staff across the country. The first phrase is this: Hopelessness never got anything done. It struck me as having two important applications to our work. First, the work we do is hard--and I’m not talking about the day-to-day work of underwriting or portfolio managing, I’m talking about the work of creating more just and equitable neighborhoods where everyone can thrive. In fact, at times it can be discouraging to think about how long the impact lending industry has been around, and how many problems persist today. But you know what? Despairing won’t do us any good. There’s no doubt that doing the next loan is a good thing. Taking the next step makes some progress. While I can’t guarantee that we’ll solve our country’s problems, I can guarantee that giving into hopelessness and doing nothing certainly won’t. So we keep pushing..

The other application for us is from the perspective of our neighbors that we are trying to help. If you grow up in an environment that exposes you daily to structural racism, failing schools, a lack of accessible job opportunities, and unaffordable housing, resorting to hopelessness is one logical response. And in that state, it becomes very hard to find those few opportunities that might exist, or believe in yourself, or, in short, get anything done to improve your situation. We want to build the affordable housing, create the excellent schools, and provide for job opportunities that can undo that--give hope where there is none. That’s critical work and can have such an impact on someone’s life. So once again--we keep pushing. We look forward to continuing to do what we can with you, our clients and partners, in 2024, all while also thinking about how to do more and do differently to make a bigger difference than we have already. This is the final segment in a three-part series on the likely impacts of a recession on the CDFI industry. Part 1 focused on the negative impacts, Part 2 focused on potential opportunities, and this final installment offers guidance on how CDFIs can position themselves to thrive--even in a recession.

In the days since we published Part 2, more signs of recession have emerged—August inflation came in higher than anticipated, markets are forecasting as much as a 100-basis point rate increase, and stocks had their worst day since pandemic-driven volatility in 2020. The urgency to prepare for resiliency in a recession is clear. Read on for our recommendations for the impact lending industry. Know your ALM. Asset-liability matching (“ALM”), or the process of ensuring capital inflows from your portfolio are sufficient to meet required outflows to your capital providers, is easy to underemphasize in a strong economy. During a recession, we no longer have the luxury of assuming that strong repayment and easy access to capital will prevent ALM challenges. Lenders need a dynamic model with scenario forecasting to understand how a changing economic landscape could impact their ability to perform on their liabilities. This should inform all aspects of an impact lender’s operations, from credit standards to portfolio management and fundraising. Two specific liquidity pressures during a recession are increasing payment defaults and, especially for predevelopment and minipermanent lenders, maturity extensions. A dynamic ALM model, such as the customized model offered by High Impact, can allow CDFIs to stress-test their cash position under different delinquency and extension scenarios, giving staff and the board the insights necessary to proactively manage risk. Having a strong understanding of your ALM position can also help you live out your mission. Providing payment deferrals to borrowers is a great support CDFIs can offer in a recession, but this can only be done responsibly if the CDFI can model how deferrals will impact its cash position. Once again, a dynamic ALM model can offer those insights on-demand. Lenders interested in improving their asset-liability matching practices can reach out to High Impact here to talk about our dynamic model, or get started with the free, simplified model offered in the resources section of the CDFI Connect platform maintained by the Opportunity Finance Network (“OFN”). Prepare to onboard staff transitioning from traditional finance. Banks will shed staff as a recession worsens, particularly in originations. For the many CDFIs who have been struggling to hire, this is a meaningful opportunity to add talented staff. To capitalize on this, CDFIs first need to get these potential new hires in the door. Aligning job titles with traditional banking job titles, keeping a presence within your local chamber of commerce, and acting quickly if layoffs at a local lender occur are all helpful steps. Perhaps most importantly, communicating the mission of your institution and your cultural differentiators in job posts will help convey why your ‘Senior Credit Analyst’ opening should rise above the rest in an applicant’s search. Once new hires are made, training must be the focus. For many CDFIs, this will require changes in how training is approached. Staff coming into the industry from traditional finance will likely be strong in lending and credit fundamentals but will need to change how they deploy those strengths. As an example, a bank underwriter may be accustomed to a rigorous market analysis as the cornerstone of a market-rate multifamily project underwriting, while in our field the market is emphasized much less given the massive demand for affordable housing in most communities. Similarly, key subsidy sources and certain loan types, like unsecured predevelopment loans, may be entirely new concepts. These differences can make even experienced bankers feel out of their depth initially, making good onboarding practices critical so that they can get comfortable quickly and maintain their confidence. Creating a full-fledged training program for workers transitioning to impact finance is likely too large a task for any one CDFI. We would love to see OFN or a collective of industry players come together to work toward a training program to make this transition easier—this is an opportunity that is too great to be missed. Increase risk tolerance—and show how resilient you are. This may be an unexpected perspective from a firm whose core practices include underwriting and risk mitigation. However, the CDFI industry is entering this recession in a very strong position and now has decades of extremely low loss rates to support its efficacy—as noted in Part 1, OFN found that the peak average delinquency and charge-off rates among unregulated CDFIs from 1994 to 2013 were 5.8% and 2.1%, respectively. Based on our work in portfolio analytics and portfolio management, we can anecdotally attest to the high performance of CDFI portfolios. This may be the time to strategically increase risk tolerance to double down on our core mission of filling capital gaps and providing financing to empower the most vulnerable borrowers. For impact lenders willing to take more risk, the key is to do so strategically. First, identify the specific vulnerable population you want to support. Is it small businesses with high-cost debt? Minority-owned developers waiting to realize developer fees? Homeowners who lost their jobs? Making this group as specific as possible will increase the likelihood that you can target them successfully and tailor a higher risk product or approach to achieve the intended impact. Next, see 'Know Your ALM' above—make sure you can model how the downside scenario of this strategy could impact your liquidity. Finally, get investors on board by demonstrating to them how much you could lose without failing to repay them, explaining how your strategic approach mitigates risk to the extent possible, and by dedicating specific grant funds or other sources to credit enhance the strategy. Lenders who are bold and purposeful in a recession will strengthen their communities in their darkest hour while fearlessly pursuing the ultimate vision of our industry. Thank you for reading this series. We invite you to leave your own thoughts in the comments, respond to our post on LinkedIn, or reach out to us at [email protected] if you’d like to discuss how we can help make sure your CDFI is resilient in a recession. |

RSS Feed

RSS Feed