High Impact’s all-in-one forecasting and risk analysis platform empowers smarter decision making.

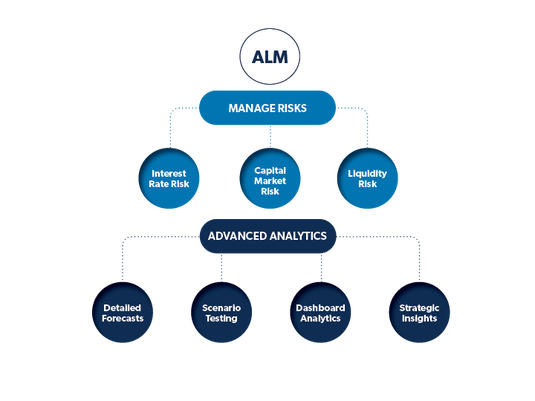

Effective capital planning in any economic environment encompasses more than ensuring short-term funding needs are met. High Impact’s asset-liability matching (ALM) model provides actionable insights to enable smarter capital planning and risk mitigation.

Effective capital planning in any economic environment encompasses more than ensuring short-term funding needs are met. High Impact’s asset-liability matching (ALM) model provides actionable insights to enable smarter capital planning and risk mitigation.

High Impact's ALM Model is designed to fit your needs:

ComprehensiveIncorporate current and projected loan portfolios, grant income, product mixes & capital sources

|

FlexibleModel supports a wide range of product types and repayment terms

|

CustomizableRefinancing rates, forbearance structures, and distribution/repayments assumptions are just some of the adjustable variables

|

TimelyCash flow forecasts & analytics can be generated on a rolling basis

|

ALM Model |

High Impact’s ALM model allows you to easily understand your fund’s expected cash inflows and outflows, run and stress test customizable scenarios and evaluate projected performance along key performance indicators.

The ALM model’s intuitive dashboard puts the insights and answers you need at your fingertips, including built-in analytics that identify any period(s) where a program is projected to be underfunded or fall short of a specified liquidity benchmark. With High Impact’s ALM, your team can:

|

Developed by Experts Who Know CDFIs.

Our team has harnessed our strategic capitalization expertise to create an ALM modeling tool that fits the unique needs of CDFIs. High Impact’s ALM levels the playing field for small and mid-sized CDFIs and equips them with the tools and data-driven analytics employed by large lenders and international micro-lenders.

As you implement our ALM, High Impact’s team of experts will guide you every step of the way.

Our team has harnessed our strategic capitalization expertise to create an ALM modeling tool that fits the unique needs of CDFIs. High Impact’s ALM levels the playing field for small and mid-sized CDFIs and equips them with the tools and data-driven analytics employed by large lenders and international micro-lenders.

As you implement our ALM, High Impact’s team of experts will guide you every step of the way.

Email us to learn more and schedule a demo.