|

This is the second in a three-part series that will consider the likely impacts of a recession on the CDFI industry. Part 1 focused on the negative impacts. Part 2 focuses on the positive impacts. Part 3 will provide suggestions for how CDFIs can position themselves to thrive—recession or no recession.

The prospects of a recession are unsettling to us all in the impact finance space—a recession means people losing their jobs, entrepreneurs closing their doors, and opportunities for homeownership vanishing. It makes the work we do and the mission we strive for even harder to accomplish. It also amplifies the importance of CDFIs and other impact lenders and investors. As markets retrench in the face of inflation and economic contraction, the impact finance ecosystem must work hard to find innovative ways to blunt the impacts of economic turmoil on the most vulnerable residents in our communities. With that in mind, this post considers the potential opportunities within a recession that can help us all propel our mission forward no matter the economic headwinds. Part 2: Favorable Impacts Higher Credit Loan Requests As conventional lenders tighten their lending parameters, impact lenders will start to see applications coming in from businesses who were bankable just a few weeks or months prior. This offers the immediate and mid-range benefits of adding very high credit quality loans to the portfolio. Impact lenders can leverage this in two ways—most conservatively, to offset a potential influx of delinquencies and losses in their existing portfolios as economic conditions worsen, or, perhaps more bravely in service to mission, to justify new, higher-risk lending to traditional CDFI borrowers as they face the recession. Leaning into riskier loans during a recession is a high-risk, high-impact strategy, but CDFIs may be able to do so prudently if they are closing higher credit quality loans at the same time. Experienced Lenders on the Job Hunt The impact finance industry has not been immune from the macroeconomic trend of staff departures and staffing shortages. Nearly all of our clients at High Impact—and our firm too, for that matter—have experienced higher than normal staff turnover in the last two years. Hiring new staff has been difficult given the number of institutions with competing offers and the friction caused by individuals changing industries or stepping back from the workforce. In a recession, as banks cut back lending activity, we can expect to see layoffs and slower hiring trends among traditional financial institutions. CDFIs who are ready for this will be able to hire and train finance professionals who are newly on the job market and want their next job to have a real impact in their communities. This could be the influx of qualified personnel that the industry has been looking for. At High Impact, we’ve had several good experiences hiring staff from traditional financing institutions. Once they get past the initial culture shock—“there’s no collateral at all?” and “you want me to honestly tell you what I think about our workplace?”—their skills are highly transferrable, and the different perspective can be a major benefit, particularly if other staff come from more of a grassroots community development background. Continued Spotlight on the Importance of Impact Finance The visibility of the Black Lives Matter movement in the wake of George Floyd’s murder and the unprecedented economic shutdown caused by the pandemic have put CDFIs and impact finance into the spotlight like never before. The capital inflows from both government and private resources that followed have positioned the industry to not just be resilient during a recession, but to continue growth and increase impact. If the industry can use this newfound spotlight to demonstrate how to drive just capital allocation even during a recession, impact lenders have the opportunity to cement their place in the consciousness of Americans as the economic first responders that they are. The long-term benefit that could come from that could be industry-changing. What’s Next With the most likely negative and positive impacts of the recession behind us, the final post in this series will present proactive steps CDFIs and others in the industry can take to ensure that we are all ready to react strategically and proactively when a recession hits.

1 Comment

As economic indicators increasingly point to a recession, understanding a recession's likely impacts on our industry can help us react strategically as the economy changes. This is critical for any sector, but for CDFIs it is not just an existential moment to ensure self-survival, it is an urgent call to action to be economic first responders for our most vulnerable neighbors and communities. Just as airplane passengers should put on their own oxygen mask before helping others, CDFIs should ready themselves now so that they can support their constituents when an economic emergency arrives. This is the first in a three-part series that will consider the likely impacts of a recession on the CDFI industry. Part 1 focuses on the negative impacts, Part 2 focuses on the potential silver lining, and Part 3 provides suggestions for how CDFIs can position themselves to thrive—recession or no recession. Part 1: Negative Impacts Goodbye to Easy Money? The CDFI industry is enjoying an unprecedented infusion of capital from multiple sources—our industry’s version of “easy money.” The CDFI Fund airdropped over $1 million straight to the net assets of most CDFIs in 2021, and initiatives from LISC’s Black Economic Development Fund to OFN’s Finance Justice Fund and many more are deploying capital raised from corporate treasuries that in many cases had never invested in CDFIs before, or never at such scale. A recession, however, could slow or reverse this trend. As government budgets tighten and corporate boards increase an emphasis on cash on hand to mitigate recessionary risk, we can expect that the flow of new money into the industry will slow. Rising Default Rates A natural first concern for lenders in a recession is that delinquencies and charge-offs will increase. Data show that this concern is well-founded. An OFN study* of unregulated CDFI data from the 20 years from 1994 to 2013 found that the highest average delinquency rate and net charge off rate occurred in 2009 and 2010, respectively, correlating to the Great Recession (note that these high watermarks were still very manageable, at 5.8% for delinquencies and 2.1% for net charge-offs). While CDFIs should be ready for an uptick in problem loans, the impact is likely to be worse for small business lenders rather than real estate lenders. As the graph below shows, small business closures peak in recession economies. Real estate lenders, on the other hand, will likely see more resilient portfolios. Rents at a multifamily complex are paid by tenants who may collectively source income from dozens of employers and several public subsidy sources, decreasing the likelihood of broad nonpayment that could dent cash flow available for debt service. In the charter school lending sector, while a recession may hit government budgets and flow through to school budgets, charter schools tend to have many levers to pull to tighten their budgets and remain in operation—only the highest leveraged, and those with the most expensive leases or debt, are likely to be severely impacted by recessionary budget cuts. Given these factors, it is the same small business lenders who are only recently emerging from pandemic-driven havoc in the portfolio that should prepare for a new uptick in problem loans. *Source: 20 Years of Opportunity Finance 1994-2013: An Analysis of Trends and Growth. Published by the Opportunity Finance Network on November 10, 2015.

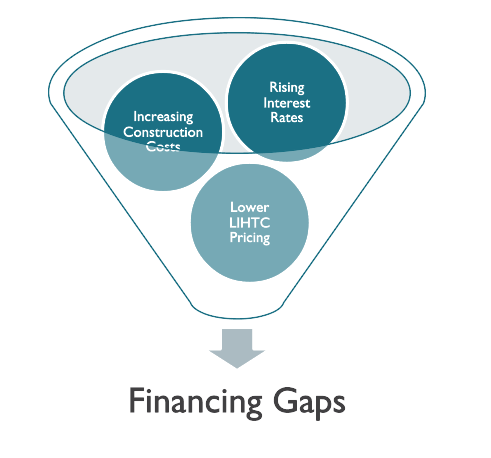

As interest rates continue to rise and before inflation moderates, gaps in construction budgets will only become more frequent. A hard recession could have the compounding impact of lowering bank profits and therefore lowering the appetite for tax credits, driving down LIHTC pricing. In 2016 we saw a similar issue with a different cause, as reductions in corporate tax rates resulted in LIHTC pricing dropping by 5-10 cents per credit or more—creating million-dollar-plus gaps in projects. Real estate developers will need to get creative to cobble together sources of funding or reduce costs to get projects to the finish line, often requiring more time than anticipated when their predevelopment funding closed. For projects that ultimately fail to move forward, by the time a project is finally abandoned corporate guarantees may be weaker than they were pre-recession, as the compounding impact of project delays and lower income from operating properties lowers developer fee receipts and cash flows from partnership waterfalls.

What’s Next Now that we’ve covered the most likely negative impacts of the recession, the next post will review the potential opportunities that lie within a recession. After that, we will cover the steps CDFIs and other industry stakeholders can take to ensure that we are all ready to react strategically and proactively when a recession hits. April 1st will be a “first First” for us at High Impact—the first day celebrating our new company policy, First Fridays Off. This policy makes the first Friday of each month a company holiday, meaning High Impact will be closed for business each first Friday going forward. It represents a radical expansion of our PTO and holidays policy—12 new days off in one fell swoop—and the biggest change in our benefits policy since our founding. We are making this move as the first step in revamping staff benefits in 2022 to acknowledge the changes and challenges of the post-pandemic business environment and reemphasize that the well-being and development of our staff comes first. This move will reinforce the attractiveness of becoming and staying a High Impact employee and position our team to continue delivering best in class client service.

Implementing this policy is further operationalizing our B Corp values to consider the interests of all of our stakeholders when making business decisions. We view this policy as a meaningful way we can encourage work-life balance and support our employees’ mental health. By forcing a free weekday once a month, our staff will all receive the mental health benefit of a “breather”—a day to slow down, give attention to our personal needs, and enjoy the “life” side of the work-life balance. We strongly believe that deliberate breaks, and not just longer (but infrequent) vacations, have an important mental health benefit. We understand that some of our clients may have concerns about how this impacts our workflow and ability to provide them with the excellent service that they rightly expect from us. At the micro level, we are confident that one day of company closure per month will not materially impact workflows—our staff have time and time again shown their capacity to meet deadlines while delivering superior analysis. Taking a longer-term view, we firmly believe that by further reinforcing our staff’s wellbeing this change will actually result in improved service for our clients. As we implement this policy, we thank our clients for their continued confidence and trust in us. And most of all, we thank our staff for their unwavering dedication to using their skills to benefit mission-driven lenders and the at-risk communities they serve. First Fridays Off is a celebration of that dedication and an acknowledgement of the hard work that they do, day in and day out. We are excited to see how everyone uses their first First Friday, whether it be by exploring the great outdoors, catching up on household needs, visiting out-of-town friends and family, or enjoying hobbies. We hope everyone finds the time to relax, reflect, and recharge—and don’t worry, we’ll be back on Monday. With implementation of the new Current Expected Credit Losses accounting standard required by December 2022, many impact lenders are beginning to feel the pressure of the impending deadline. As CDFIs begin accelerating efforts to implement CECL, many questions naturally arise.

Let’s start with the basics. What is CECL? On June 16, 2016, the FASB issued Accounting Standards Update No. 2016-13, Financial Instruments—Credit Losses (Topic 326). The new guidance requires organizations to measure expected credit losses for financial instruments considering: 1. Historical experience, 2. Current conditions, and 3. Reasonable and supportable forecasts for future performance. The dual aims of CECL are (i) to provide institutions with greater flexibility in the recognition of expected losses compared to the incurred loss approach CECL is replacing and (ii) to provide readers of financial statements greater clarity into how losses have been estimated. My CDFI has never struggled with significant losses. Do we still have to implement CECL? Yes. For many CDFIs, after years of holding 5% loan loss reserves and seeing annual charge-offs from 0-3%, going through the process of CECL implementation can seem like an undue hassle. However, high-performing CDFIs can also see this as an opportunity. CECL implementation will give you a rigorous, data-backed logic for your loss expectations, which may allow you to reduce your loan loss reserve—improving your net assets ratio and potentially improving your fundraising ability as a result. CECL sounds complicated—do I need an equally complicated system to implement it properly? Not necessarily. Federal bank regulators have said that for non-complex financial institutions—which means most CDFIs—a well-structured Excel model is sufficient to properly implement CECL. As long as high quality data and a well-reasoned framework are in place, the tool used to implement CECL does not need to be expensive, complicated, or hard to use. If I don’t need a high-cost software solution, then what do I need to implement CECL? The #1 requirement for a successful CECL implementation is quality data—both for your own institution’s performance and for external factors that can contribute to a supportable forecast for future losses. Internal data includes historic losses, information on changes in your portfolio over time, and your current portfolio composition. Institutions should perform segmentation analyses to identify loans that share risk characteristics that are likely to be deterministic of future credit losses across various economic conditions. External factors that may become part of your forecast can include data on the U.S. economy, sectors you lend in, the CDFI industry, and other relevant indicators. Once you have that data assembled, you need to enter it into a model that can interpret it to produce the “supportable forecast” that is key to CECL. What can High Impact do to help? Our team specializes in CDFI portfolios and understands the common data challenges CDFIs face when trying to conduct fund analytics. We manage data compilation, scrubbing, and analytics leveraging our deep CDFI knowledge. After analyzing portfolio performance, our team is able to recommend and implement a modeling approach that fits your organization. Our team will design an Excel-based model that integrates internal and external data to develop supportable forecasts for future losses. Over the course of a 2-3 month engagement, we will populate the model for you and provide recommendations for loan loss reserve holdings that are consistent with CECL guidance. At the end of the engagement, we turn the model over to you for your ongoing internal use. Engaging High Impact is the stress-free, long-term solution to CECL implementation for CDFIs. Interested in engaging High Impact for your CECL implementation? Contact us today at [email protected] or visit our CECL webpage to book a call. For the past four quarters, High Impact worked alongside The Community Development Trust to release charter school market scans covering four specific state markets: Tennessee, California, New Jersey and Colorado. We learned a great deal about the charter market through this process, from getting access to information to understanding how the nationally present charter school debate trickles down to the state and local level. In this blog post, we share our tips and update the political outlook in our focus states as we begin 2019.

Finding Data

The recent midterm elections resulted in changes in state leadership that may impact charter school growth in our focus states. Tennessee:

California:

New Jersey:

Colorado:

To learn more about the charter school markets in these states, you can review our state scans here. As the High Impact team has grown this year, the skills, backgrounds, and roles of our team have become more diverse. A critical thread is shared among all of us, though: a commitment to positively impacting America's most distressed communities. But what impact are we seeking, and how will we make it happen? The answers to these questions are crystallized in High Impact's first-ever vision statement: Conscious capital and innovative partnerships create thriving communities. We want not just to expand economic opportunities in low-income communities. We don't only want to contribute to the production of quality affordable housing, or improved facilities for high-performing schools. Rather, it is the sum of all those parts and more that we seek--it is the creation of thriving communities. A thriving community has opportunities to earn an income and build wealth, it has residents who don't feel the stress of housing insecurity, and it has schools that equip students to reach their potential. But it also has happy, fulfilled people, neighborhood pride, big dreamers, and the comfort of safety. Helping all communities thrive is what our work is all about.

With the goal defined, the next step was figuring out how we can pursue such an ambitious vision. We concluded that conscious capital and innovative partnerships are the two critical, non-negotiable ingredients that will be core to our success. Conscious capital acknowledges that money is necessary to move the needle on these intractable problems, and it has to be money that's used in a thoughtful, human-first way. It's capitalism that understands and privileges the simple idea that people are greater than profit. Innovative partnerships are so important to us because while we are ambitious, we know that we can't make the big changes that we believe in on our own. We need to bring our specific skill set to the table and combine that with the expertise and capacity of our collaborators to maximize our impact. We need to encourage ourselves and others to think differently, act boldly, and work together to drive positive change. Our vision statement is a commitment. It is a motivator. And it is our greatest dream as a company. We invite you to join us as we bring it to life. At High Impact, we’re excited about the Opportunity Zones program and its potential to kickstart a wave of long-term investment into economically distressed communities across America. Since the program was announced as part of last year’s tax plan, we’ve been closely following the program’s progression and are eagerly awaiting final guidance on its implementation.

To High Impact, it’s clear that mission-focused stakeholders will need to proactively engage with the Opportunity Zones program to ensure the program delivers on its promise of meaningful job creation and economic development for low-income communities. Unlike other tax incentive programs like New Markets Tax Credits (NMTCs) or Low-Income Housing Tax Credits (LIHTCs), the Opportunity Zones program will not regulate investment through specialized financial intermediaries or an application process. Unencumbered by these restrictions, investment will flow towards projects and geographies that promise the greatest expected return. With that in mind, we stand ready to help our clients and others who calculate returns not only in dollars earned but also in social impact access this program. For our readers who aren’t familiar with the Opportunity Zones program, great resources already exist covering the program’s structure. The IRS (link) and the Economic Innovation Group (link) provide solid background information on the program and for those looking to identify and pull information on the Qualified Opportunity Zones within their states, Enterprise Community Partner’s Opportunity360 tool (link) is a great resource. We are excited to announce the Impact Lenders Podcast, a new biweekly podcast that focuses on using lending as a force for good. Through interviews with executives, lenders, and other staff who carry out the important work of nonprofit loan funds, foundations, CDFI banks and credit unions, government entities, and their partner institutions, we will give you inspiration for your own work, remind you why you got into this field in the first place, and improve your knowledge of the field. Many of our discussions will be about affordable housing development, the growth and management of nonprofit loan funds, small business lending, commercial real estate in underserved communities, school facility development, and economic development. One of our goals as a company is to be a knowledge base for the industry, and this podcast is an extension of that goal. We hope we’ll entertain and inform, and we are excited to showcase the many great people in this industry on our show.

The first episode will be released on 4.4.2018. We look forward to hearing your feedback and hope you will enjoy the show. www.impactlenderspodcast.com This is the first in a series of blog posts that will highlight our five core values: social responsibility, integrity, professionalism, adaptability, and collaboration. Today we focus on social responsibility.

By: Camellia Loojune, Junior Analyst As an expanding organization, the High Impact team has been working to create a company culture that complements our recently developed core set of values and beliefs. Being a B Corp has played an integral role in this process. In the spirit of B Corp Awareness Month, we would like to highlight one of our values, social responsibility. We find it an absolute privilege to work with clients on projects that positively impact communities across the nation, ranging from affordable housing and charter schools to small businesses. As part of our commitment to social responsibility, each year we donate a percentage of our profit to a worthy organization, and we let one of our clients select who we should send the donation to. Using a weighted lottery system, the Reinvestment Fund (RF) based in Philadelphia, PA was the client chosen this year. RF is a community development financial institution that integrates data, policy and strategic investments to improve the quality of life in low-income neighborhoods. Using analytical and financial tools, they are able to bring high-quality grocery stores, affordable housing, schools and health centers to communities that need better access. RF polled their staff and selected Court Appointed Special Advocates (CASA) Philadelphia as the organization who will be receiving our donation of $1,500. CASA Philadelphia delivers personalized, integrated, child-centered advocacy for abused and neglected children in foster care through a diverse community of trained volunteers. RF’s Managing Director for Lending and Investment, Andy Rachlin stated: “There is no population more vulnerable or in need of more support than children who have been abused or neglected and are in the foster care system. That’s why a number of staff members at Reinvestment Fund choose to dedicate their volunteer time to CASA and why we wanted High Impact’s donation to go there as well.” We would like to thank CASA Philadelphia for the tremendous work they do, and hope that this modest donation makes a difference. To learn more about their organization, please go to: http://www.casaphiladelphia.org/.

The report brings together information on laws, accountability, academic performance, demographic mix, and funding information related to charter schools in the Volunteer State. The report is not an analysis, and it is not an opinion piece. Rather, it is a collection of information that was diffused across various sources into one concise report. We hope you find it to be a valuable resource.

Why is such a report important? Simple: a higher degree of transparency will help the charter school sector (and the students filling its classrooms!) succeed. High quality information can help bring new players into the market and improve outcomes for those already involved. We hope State Scans will be the first report a lender reviews when underwriting a deal in a new state, or that a charter management organization turns to when considering expansion across state lines. We even believe that experienced operators in Tennessee may learn something new when reviewing our report. On a grander scale, we hope this series of reports can play a small role in helping combat the misinformation and simple misunderstandings that are common in the important debates about education playing out daily on comment boards and in policy meetings throughout the U.S. There is confusion on major points—no, charter schools cannot handpick students, and yes, charter schools are fully public schools—as well as the finer details, many of which vary considerably from state to state. Friends and colleagues are often shocked to learn the charter school on whose board I served had unionized teachers. Many opponents think that charter schools and for profit operating companies are synonymous. Funding formulas challenge even the keenest policy wonk’s understanding. All of these points of confusion indicate a need for clearer, better organized information. State Scans is our attempt to provide it. Click here to access the report, and don’t forget to enter your email to get future releases delivered straight to your inbox. We welcome your feedback on our Tennessee edition and look forward to shining a light on other states in the year to come. |

RSS Feed

RSS Feed