|

This is the final segment in a three-part series on the likely impacts of a recession on the CDFI industry. Part 1 focused on the negative impacts, Part 2 focused on potential opportunities, and this final installment offers guidance on how CDFIs can position themselves to thrive--even in a recession.

In the days since we published Part 2, more signs of recession have emerged—August inflation came in higher than anticipated, markets are forecasting as much as a 100-basis point rate increase, and stocks had their worst day since pandemic-driven volatility in 2020. The urgency to prepare for resiliency in a recession is clear. Read on for our recommendations for the impact lending industry. Know your ALM. Asset-liability matching (“ALM”), or the process of ensuring capital inflows from your portfolio are sufficient to meet required outflows to your capital providers, is easy to underemphasize in a strong economy. During a recession, we no longer have the luxury of assuming that strong repayment and easy access to capital will prevent ALM challenges. Lenders need a dynamic model with scenario forecasting to understand how a changing economic landscape could impact their ability to perform on their liabilities. This should inform all aspects of an impact lender’s operations, from credit standards to portfolio management and fundraising. Two specific liquidity pressures during a recession are increasing payment defaults and, especially for predevelopment and minipermanent lenders, maturity extensions. A dynamic ALM model, such as the customized model offered by High Impact, can allow CDFIs to stress-test their cash position under different delinquency and extension scenarios, giving staff and the board the insights necessary to proactively manage risk. Having a strong understanding of your ALM position can also help you live out your mission. Providing payment deferrals to borrowers is a great support CDFIs can offer in a recession, but this can only be done responsibly if the CDFI can model how deferrals will impact its cash position. Once again, a dynamic ALM model can offer those insights on-demand. Lenders interested in improving their asset-liability matching practices can reach out to High Impact here to talk about our dynamic model, or get started with the free, simplified model offered in the resources section of the CDFI Connect platform maintained by the Opportunity Finance Network (“OFN”). Prepare to onboard staff transitioning from traditional finance. Banks will shed staff as a recession worsens, particularly in originations. For the many CDFIs who have been struggling to hire, this is a meaningful opportunity to add talented staff. To capitalize on this, CDFIs first need to get these potential new hires in the door. Aligning job titles with traditional banking job titles, keeping a presence within your local chamber of commerce, and acting quickly if layoffs at a local lender occur are all helpful steps. Perhaps most importantly, communicating the mission of your institution and your cultural differentiators in job posts will help convey why your ‘Senior Credit Analyst’ opening should rise above the rest in an applicant’s search. Once new hires are made, training must be the focus. For many CDFIs, this will require changes in how training is approached. Staff coming into the industry from traditional finance will likely be strong in lending and credit fundamentals but will need to change how they deploy those strengths. As an example, a bank underwriter may be accustomed to a rigorous market analysis as the cornerstone of a market-rate multifamily project underwriting, while in our field the market is emphasized much less given the massive demand for affordable housing in most communities. Similarly, key subsidy sources and certain loan types, like unsecured predevelopment loans, may be entirely new concepts. These differences can make even experienced bankers feel out of their depth initially, making good onboarding practices critical so that they can get comfortable quickly and maintain their confidence. Creating a full-fledged training program for workers transitioning to impact finance is likely too large a task for any one CDFI. We would love to see OFN or a collective of industry players come together to work toward a training program to make this transition easier—this is an opportunity that is too great to be missed. Increase risk tolerance—and show how resilient you are. This may be an unexpected perspective from a firm whose core practices include underwriting and risk mitigation. However, the CDFI industry is entering this recession in a very strong position and now has decades of extremely low loss rates to support its efficacy—as noted in Part 1, OFN found that the peak average delinquency and charge-off rates among unregulated CDFIs from 1994 to 2013 were 5.8% and 2.1%, respectively. Based on our work in portfolio analytics and portfolio management, we can anecdotally attest to the high performance of CDFI portfolios. This may be the time to strategically increase risk tolerance to double down on our core mission of filling capital gaps and providing financing to empower the most vulnerable borrowers. For impact lenders willing to take more risk, the key is to do so strategically. First, identify the specific vulnerable population you want to support. Is it small businesses with high-cost debt? Minority-owned developers waiting to realize developer fees? Homeowners who lost their jobs? Making this group as specific as possible will increase the likelihood that you can target them successfully and tailor a higher risk product or approach to achieve the intended impact. Next, see 'Know Your ALM' above—make sure you can model how the downside scenario of this strategy could impact your liquidity. Finally, get investors on board by demonstrating to them how much you could lose without failing to repay them, explaining how your strategic approach mitigates risk to the extent possible, and by dedicating specific grant funds or other sources to credit enhance the strategy. Lenders who are bold and purposeful in a recession will strengthen their communities in their darkest hour while fearlessly pursuing the ultimate vision of our industry. Thank you for reading this series. We invite you to leave your own thoughts in the comments, respond to our post on LinkedIn, or reach out to us at [email protected] if you’d like to discuss how we can help make sure your CDFI is resilient in a recession.

0 Comments

This is the second in a three-part series that will consider the likely impacts of a recession on the CDFI industry. Part 1 focused on the negative impacts. Part 2 focuses on the positive impacts. Part 3 will provide suggestions for how CDFIs can position themselves to thrive—recession or no recession.

The prospects of a recession are unsettling to us all in the impact finance space—a recession means people losing their jobs, entrepreneurs closing their doors, and opportunities for homeownership vanishing. It makes the work we do and the mission we strive for even harder to accomplish. It also amplifies the importance of CDFIs and other impact lenders and investors. As markets retrench in the face of inflation and economic contraction, the impact finance ecosystem must work hard to find innovative ways to blunt the impacts of economic turmoil on the most vulnerable residents in our communities. With that in mind, this post considers the potential opportunities within a recession that can help us all propel our mission forward no matter the economic headwinds. Part 2: Favorable Impacts Higher Credit Loan Requests As conventional lenders tighten their lending parameters, impact lenders will start to see applications coming in from businesses who were bankable just a few weeks or months prior. This offers the immediate and mid-range benefits of adding very high credit quality loans to the portfolio. Impact lenders can leverage this in two ways—most conservatively, to offset a potential influx of delinquencies and losses in their existing portfolios as economic conditions worsen, or, perhaps more bravely in service to mission, to justify new, higher-risk lending to traditional CDFI borrowers as they face the recession. Leaning into riskier loans during a recession is a high-risk, high-impact strategy, but CDFIs may be able to do so prudently if they are closing higher credit quality loans at the same time. Experienced Lenders on the Job Hunt The impact finance industry has not been immune from the macroeconomic trend of staff departures and staffing shortages. Nearly all of our clients at High Impact—and our firm too, for that matter—have experienced higher than normal staff turnover in the last two years. Hiring new staff has been difficult given the number of institutions with competing offers and the friction caused by individuals changing industries or stepping back from the workforce. In a recession, as banks cut back lending activity, we can expect to see layoffs and slower hiring trends among traditional financial institutions. CDFIs who are ready for this will be able to hire and train finance professionals who are newly on the job market and want their next job to have a real impact in their communities. This could be the influx of qualified personnel that the industry has been looking for. At High Impact, we’ve had several good experiences hiring staff from traditional financing institutions. Once they get past the initial culture shock—“there’s no collateral at all?” and “you want me to honestly tell you what I think about our workplace?”—their skills are highly transferrable, and the different perspective can be a major benefit, particularly if other staff come from more of a grassroots community development background. Continued Spotlight on the Importance of Impact Finance The visibility of the Black Lives Matter movement in the wake of George Floyd’s murder and the unprecedented economic shutdown caused by the pandemic have put CDFIs and impact finance into the spotlight like never before. The capital inflows from both government and private resources that followed have positioned the industry to not just be resilient during a recession, but to continue growth and increase impact. If the industry can use this newfound spotlight to demonstrate how to drive just capital allocation even during a recession, impact lenders have the opportunity to cement their place in the consciousness of Americans as the economic first responders that they are. The long-term benefit that could come from that could be industry-changing. What’s Next With the most likely negative and positive impacts of the recession behind us, the final post in this series will present proactive steps CDFIs and others in the industry can take to ensure that we are all ready to react strategically and proactively when a recession hits. As economic indicators increasingly point to a recession, understanding a recession's likely impacts on our industry can help us react strategically as the economy changes. This is critical for any sector, but for CDFIs it is not just an existential moment to ensure self-survival, it is an urgent call to action to be economic first responders for our most vulnerable neighbors and communities. Just as airplane passengers should put on their own oxygen mask before helping others, CDFIs should ready themselves now so that they can support their constituents when an economic emergency arrives. This is the first in a three-part series that will consider the likely impacts of a recession on the CDFI industry. Part 1 focuses on the negative impacts, Part 2 focuses on the potential silver lining, and Part 3 provides suggestions for how CDFIs can position themselves to thrive—recession or no recession. Part 1: Negative Impacts Goodbye to Easy Money? The CDFI industry is enjoying an unprecedented infusion of capital from multiple sources—our industry’s version of “easy money.” The CDFI Fund airdropped over $1 million straight to the net assets of most CDFIs in 2021, and initiatives from LISC’s Black Economic Development Fund to OFN’s Finance Justice Fund and many more are deploying capital raised from corporate treasuries that in many cases had never invested in CDFIs before, or never at such scale. A recession, however, could slow or reverse this trend. As government budgets tighten and corporate boards increase an emphasis on cash on hand to mitigate recessionary risk, we can expect that the flow of new money into the industry will slow. Rising Default Rates A natural first concern for lenders in a recession is that delinquencies and charge-offs will increase. Data show that this concern is well-founded. An OFN study* of unregulated CDFI data from the 20 years from 1994 to 2013 found that the highest average delinquency rate and net charge off rate occurred in 2009 and 2010, respectively, correlating to the Great Recession (note that these high watermarks were still very manageable, at 5.8% for delinquencies and 2.1% for net charge-offs). While CDFIs should be ready for an uptick in problem loans, the impact is likely to be worse for small business lenders rather than real estate lenders. As the graph below shows, small business closures peak in recession economies. Real estate lenders, on the other hand, will likely see more resilient portfolios. Rents at a multifamily complex are paid by tenants who may collectively source income from dozens of employers and several public subsidy sources, decreasing the likelihood of broad nonpayment that could dent cash flow available for debt service. In the charter school lending sector, while a recession may hit government budgets and flow through to school budgets, charter schools tend to have many levers to pull to tighten their budgets and remain in operation—only the highest leveraged, and those with the most expensive leases or debt, are likely to be severely impacted by recessionary budget cuts. Given these factors, it is the same small business lenders who are only recently emerging from pandemic-driven havoc in the portfolio that should prepare for a new uptick in problem loans. *Source: 20 Years of Opportunity Finance 1994-2013: An Analysis of Trends and Growth. Published by the Opportunity Finance Network on November 10, 2015.

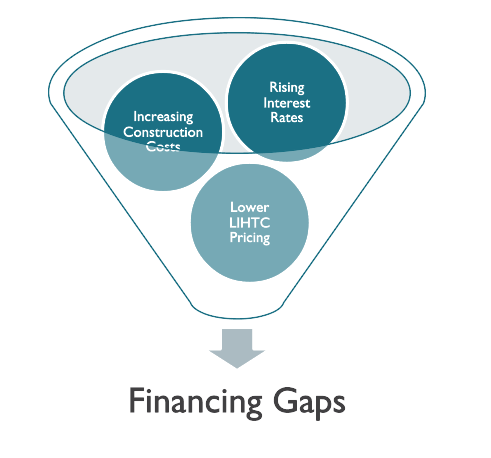

As interest rates continue to rise and before inflation moderates, gaps in construction budgets will only become more frequent. A hard recession could have the compounding impact of lowering bank profits and therefore lowering the appetite for tax credits, driving down LIHTC pricing. In 2016 we saw a similar issue with a different cause, as reductions in corporate tax rates resulted in LIHTC pricing dropping by 5-10 cents per credit or more—creating million-dollar-plus gaps in projects. Real estate developers will need to get creative to cobble together sources of funding or reduce costs to get projects to the finish line, often requiring more time than anticipated when their predevelopment funding closed. For projects that ultimately fail to move forward, by the time a project is finally abandoned corporate guarantees may be weaker than they were pre-recession, as the compounding impact of project delays and lower income from operating properties lowers developer fee receipts and cash flows from partnership waterfalls.

What’s Next Now that we’ve covered the most likely negative impacts of the recession, the next post will review the potential opportunities that lie within a recession. After that, we will cover the steps CDFIs and other industry stakeholders can take to ensure that we are all ready to react strategically and proactively when a recession hits. |

RSS Feed

RSS Feed