|

Peter Schaeffing, President

During Black History Month, we appreciate the progress made and the long journey ahead toward racial equity and the destruction of structural racism. Being involved in lending, we have a front-row seat to some of the hallmarks of structural racism. The concept of CDFIs originated in large part due to the economic exclusion of minorities from mainstream financial institutions and, through the pernicious and institutionalized practice of redlining, particularly from the mortgage market. In the present day, many of our clients now have successful programs supporting BIPOC developers as a direct response to the same issues. The necessity of these programs is, indeed, the legacy of redlining—for many Black developers, their network of family and friends have been blocked from building up the wealth and available capital needed to kickstart a career in real estate development. We commend our many clients, past and present, who recognize that need and are pursuing it rigorously—from Philadelphia Accelerator Fund, to the Leviticus 25:23 Alternative Fund, to Capital Impact Partners, Low Income Investment Fund, and LISC Fund Management. There is much work to be done, and many of our clients are boldly leading the way. We hope that this month offers the opportunity for our staff, clients, and partners to reflect on where we are, think about—and really deeply contemplate—how recently segregation and assassinations of Civil Rights leaders were the news of the day, and consider how we can aggressively move the ball forward now. My hope is that by the time I retire, we are not still working on programs supporting BIPOC developers—because by then, the need will have been met by the mainstream capital markets. For that to happen, we can’t lose our focus on this critical issue today, even as more years separate us from the jolt of action and infusions of capital that resulted from the tragic murder of George Floyd. We have to keep doing whatever we can to support projects by Black developers who are motivated by mission and who lack only the capital to impact our lowest-income and most under-resourced communities in a way that will reverberate for generations. We pledge to continue to do what we can to support this important work.

0 Comments

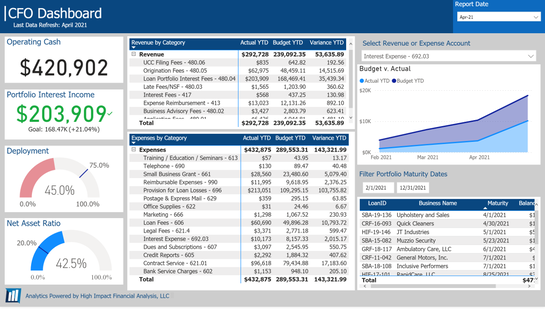

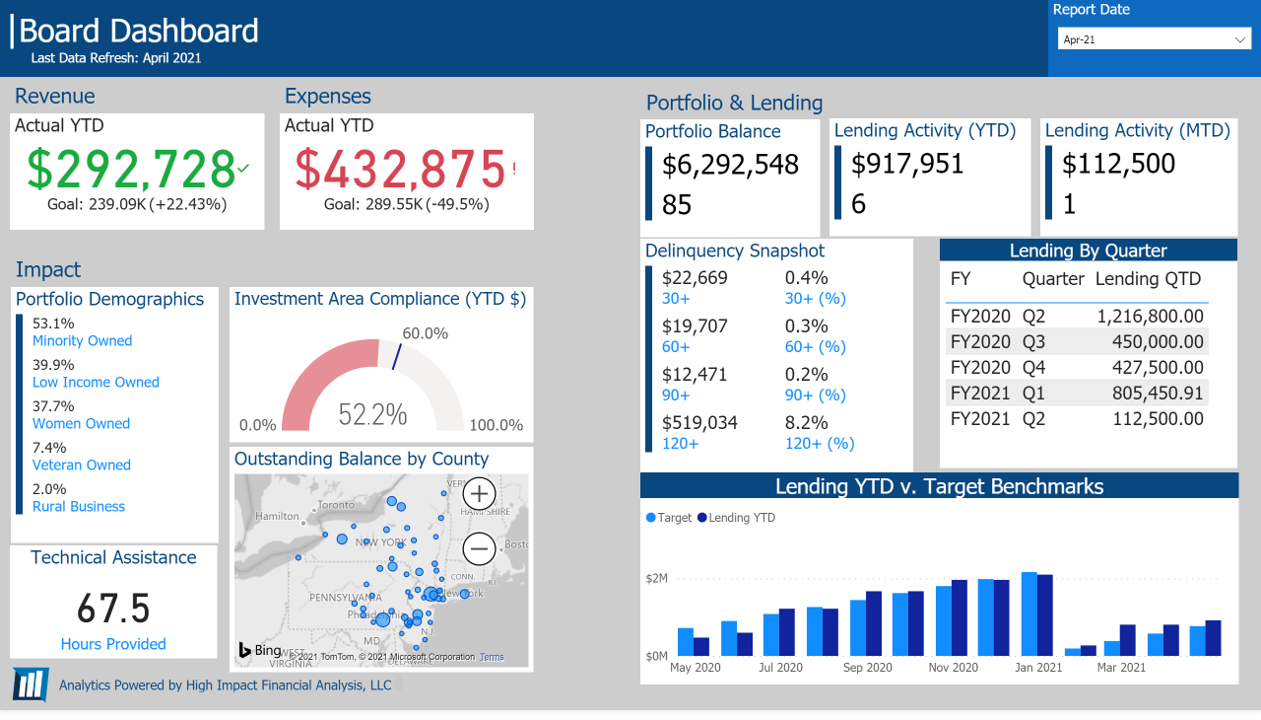

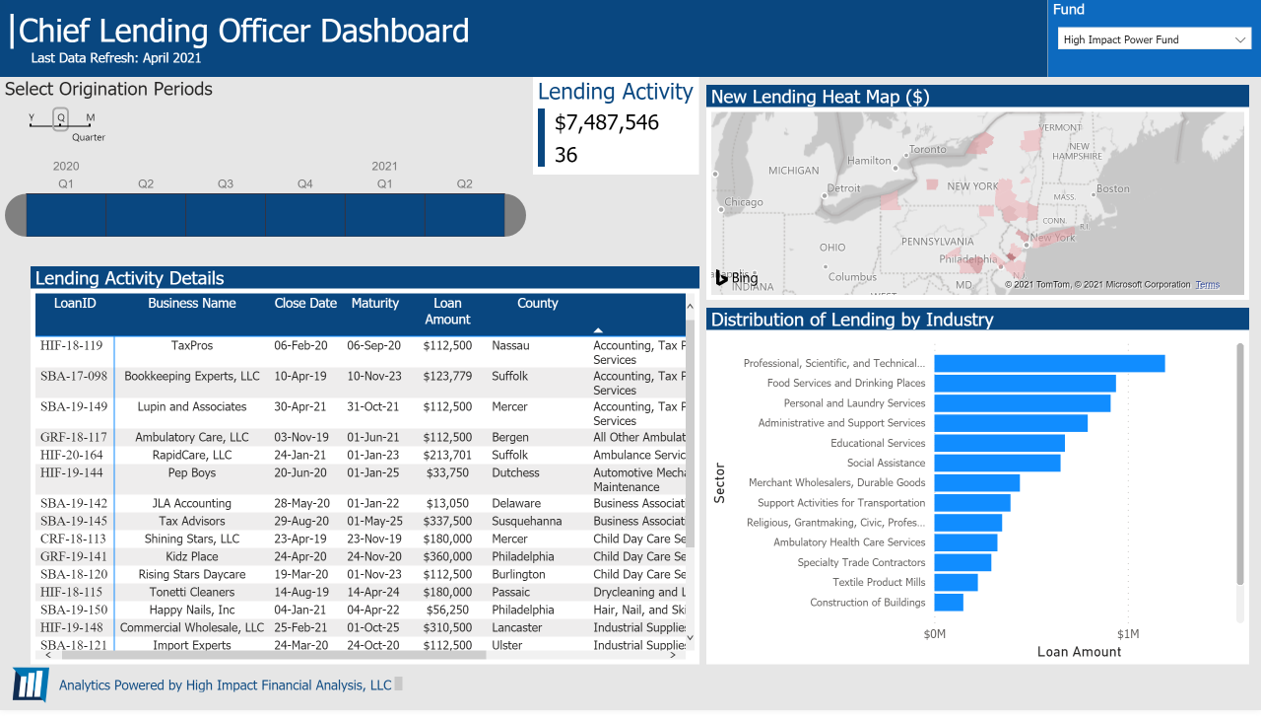

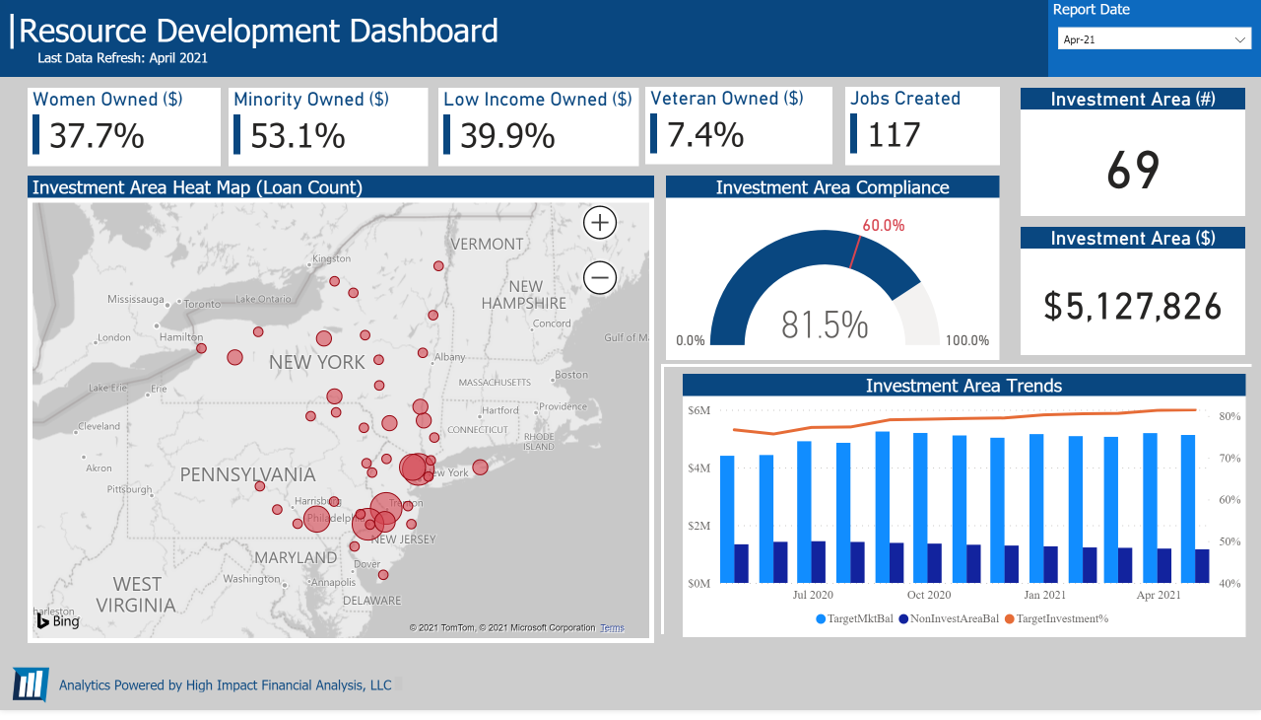

Dashboards provide critical insights through visual representations of key data and trends that are easy to interpret and direct focus to the most important information and takeaways. Effective dashboard packages utilize a combination of Summary and Supporting schedules. Summary dashboards focus on KPIs as well as key trends, ratios, and metrics, while supporting pages provide more granular insights and can leverage interactive features to support deeper analytics. For example, while a summary page might focus on total portfolio growth, supporting dashboards would include insights on the funds, products, and/or geographies driving that growth. So, what information should you include in a CDFI dashboard package? That depends on your audience. CDFIs have many different stakeholders—both internal and external—and they all need different information to meet their needs. Remember, information overload can be just as detrimental as a lack of information. Connecting stakeholders to the right information so they can act upon it is your primary goal in designing a dashboard package. This is where our High Impact Portfolio Analytics service shines. Once data modeling is complete, you have full control over which content your various audiences can access, and the data in the system can be used to create any number of targeted, interactive dashboards with specific audiences in mind. Here is our take on the top five dashboards that CDFIs need to ensure that the right data are available for the right stakeholders at all times.

#2: The Board Dashboard CDFI Boards of Directors are responsible for the overall strategy and oversight of the organization. Their needs are best met by monitoring the big-picture numbers and strategic direction. Adding in a taste of impact is critical.

#3: The Chief Lending Officer Dashboard Chief Lending Officers are often charged with both generating originations and ensuring that only good loans are made. An effective dashboard will keep an eye on both.

#4: The Resource Development Dashboard Staff focused on raising funds need to be able to effectively tell the impact story of the loan fund. Equipping them with clear, concise dashboards that communicate the success of the CDFI is critical.

By making these dashboards easy to access and update, all your critical internal and external stakeholders will have the information they need to make sound, confident decisions. High Impact configures and manages dashboards for CDFIs using our High Impact Portfolio Analytics Service in Microsoft Power BI. For more information, contact us at [email protected]. In 2024, the team at High Impact is taking turns sharing quotes that are meaningful to them. February's quote is a bold one from staff member Alex Vazquez, Portfolio Manager, care of Teddy Roosevelt: Here is Alex's explanation of what this quote means to him:

"I keep this quote close to me because it reminds me in my personal life that our efforts are what’s truly important. We cannot control outcomes nor what others have to say - but we can control our efforts. Life and especially our work can be discouraging because of not being able to see our impact in a way the moves the needle tremendously, but our efforts play a big part in moving the needle. Subconsciously, our efforts also give others permission to dare greatly as well. And together, we can move the needle of impact further than we can by ourselves!" We hope it inspires you to dare greatly, too. |

RSS Feed

RSS Feed