|

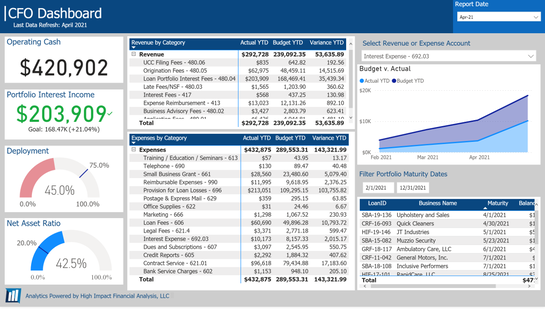

Dashboards provide critical insights through visual representations of key data and trends that are easy to interpret and direct focus to the most important information and takeaways. Effective dashboard packages utilize a combination of Summary and Supporting schedules. Summary dashboards focus on KPIs as well as key trends, ratios, and metrics, while supporting pages provide more granular insights and can leverage interactive features to support deeper analytics. For example, while a summary page might focus on total portfolio growth, supporting dashboards would include insights on the funds, products, and/or geographies driving that growth. So, what information should you include in a CDFI dashboard package? That depends on your audience. CDFIs have many different stakeholders—both internal and external—and they all need different information to meet their needs. Remember, information overload can be just as detrimental as a lack of information. Connecting stakeholders to the right information so they can act upon it is your primary goal in designing a dashboard package. This is where our High Impact Portfolio Analytics service shines. Once data modeling is complete, you have full control over which content your various audiences can access, and the data in the system can be used to create any number of targeted, interactive dashboards with specific audiences in mind. Here is our take on the top five dashboards that CDFIs need to ensure that the right data are available for the right stakeholders at all times.

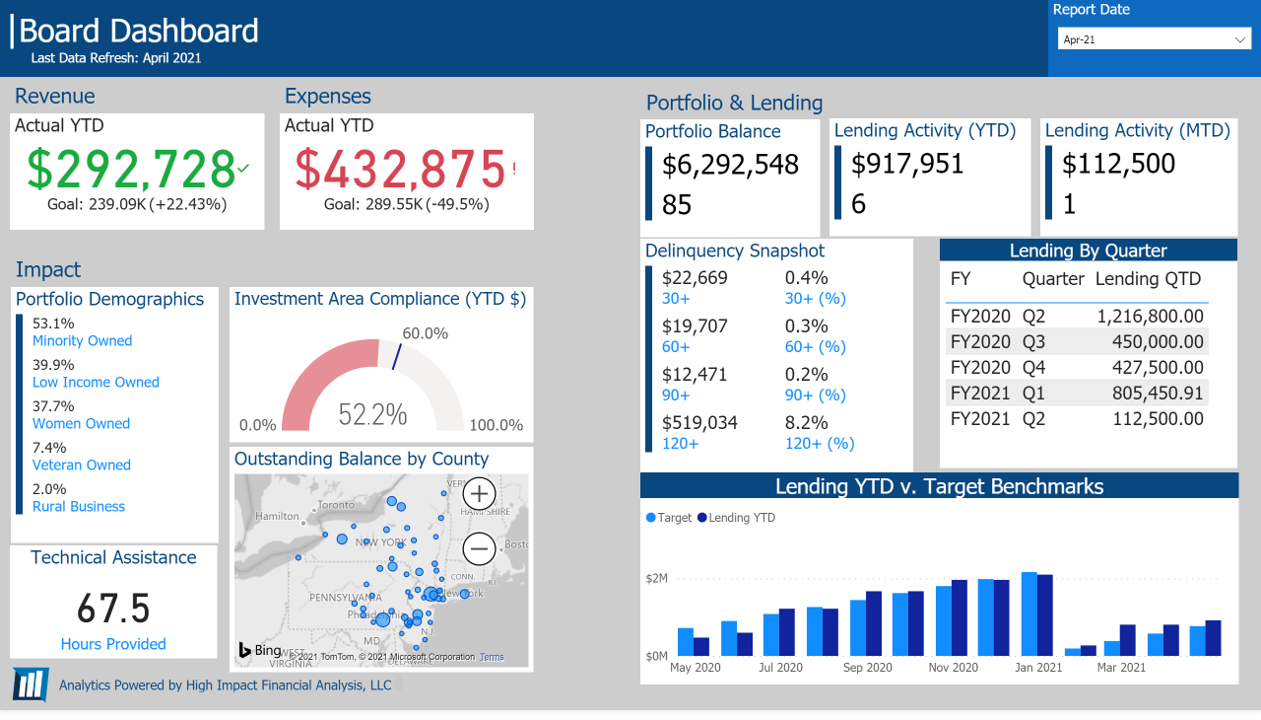

#2: The Board Dashboard CDFI Boards of Directors are responsible for the overall strategy and oversight of the organization. Their needs are best met by monitoring the big-picture numbers and strategic direction. Adding in a taste of impact is critical.

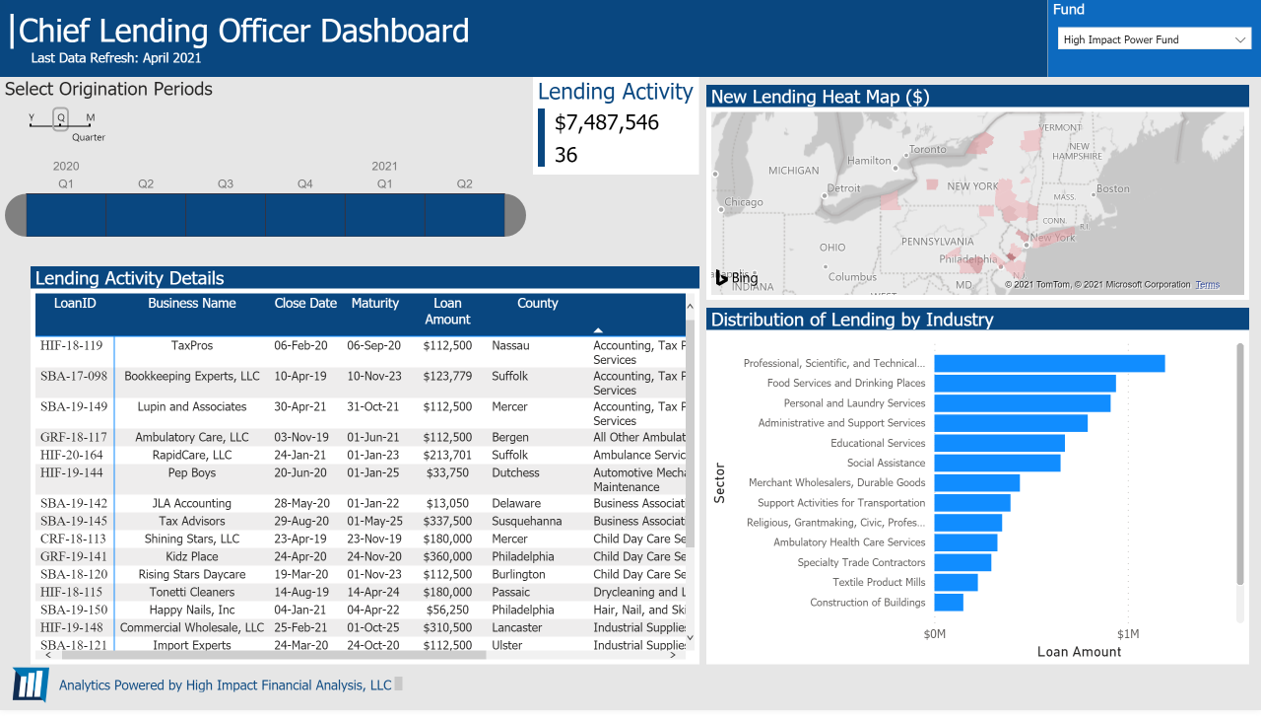

#3: The Chief Lending Officer Dashboard Chief Lending Officers are often charged with both generating originations and ensuring that only good loans are made. An effective dashboard will keep an eye on both.

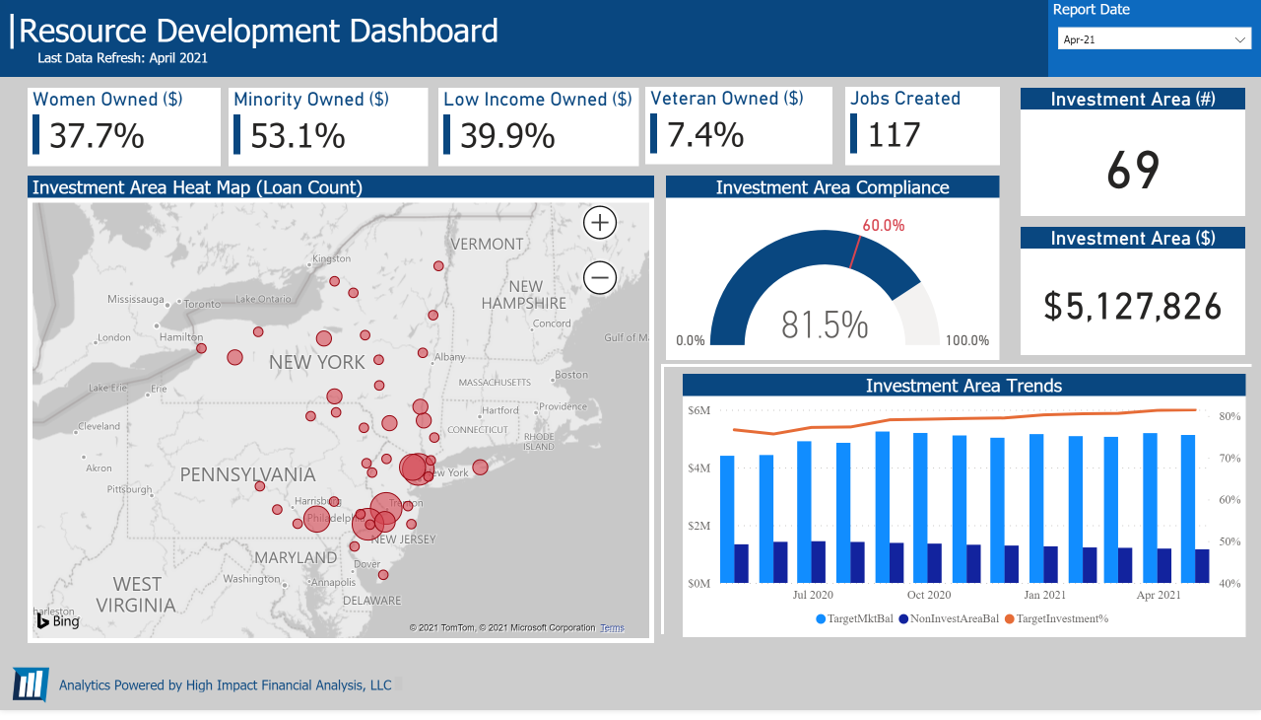

#4: The Resource Development Dashboard Staff focused on raising funds need to be able to effectively tell the impact story of the loan fund. Equipping them with clear, concise dashboards that communicate the success of the CDFI is critical.

By making these dashboards easy to access and update, all your critical internal and external stakeholders will have the information they need to make sound, confident decisions. High Impact configures and manages dashboards for CDFIs using our High Impact Portfolio Analytics Service in Microsoft Power BI. For more information, contact us at [email protected].

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed