Underwriting Services for Impact Lenders

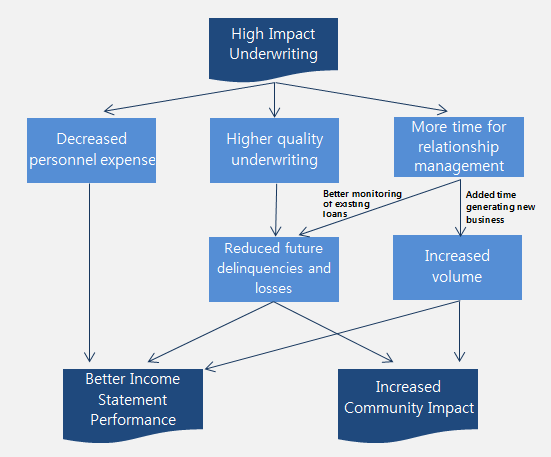

High Impact underwriting is insightful, thorough, and timely. Our services offer community development lenders the benefits of unbiased, third party underwriting backed by experience in a wide range of markets, financing structures, and subsidy programs. High Impact provides underwriting you can trust to build a strong portfolio and a stronger community.

High Impact is an incredible asset that has helped us manage periods of high underwriting volume. High Impact stepped into a deal mid-underwriting and worked directly with the borrower to deliver a comprehensive underwriting memo resulting in a few questions from our credit committee. I would highly recommend High Impact to any firm looking for an experienced and professional underwriting consultant."

-Nick Pohl, Loan Officer, Capital Impact Partners

|

High Impact underwriting is for all community development lenders. Smaller and mid-size lenders can use High Impact for all of their underwriting needs at a fraction of the cost of a full-time employee. Growing organizations and larger lenders can rely on High Impact when demand is high and as programs scale. Every lender can turn to High Impact to fill the gap in times of employee turnover or when a unique deal could use a second set of eyes. Pricing that works for all lenders. If you select our full underwriting services, you'll know the total cost upfront—no hidden fees and no hourly rates. |

Honest, critical analysis from a third party. Your underwriting process will benefit from our industry-wide experience and external perspective. Each proposed credit is thoroughly vetted by our team to ensure that all the relevant information is captured in the credit memorandum and factored into the loan structure and credit decision. Services tailored to your organization. We take the time to get to know your credit appetite and lending policies and procedures. Our services can be customized every step of the way—from credit memorandum format to borrower contact protocol. |

High Impact underwriting is built to serve you. Email us at [email protected] to learn more.