Where traditional finance shows reluctance, mission-focused lenders lead the way.

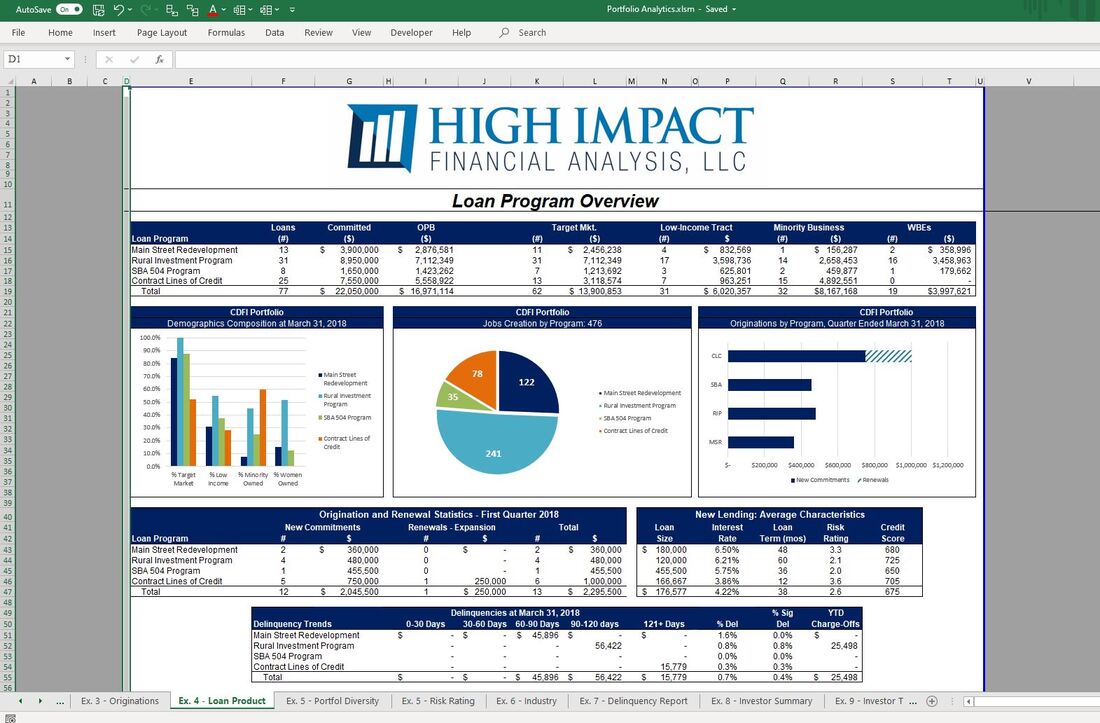

Effective portfolio management empowers your organization to maximize its impact and continue investing in new ideas and markets. High Impact's full range of portfolio analytics provide the insights and tools you need to understand and strengthen your portfolio.

Effective portfolio management empowers your organization to maximize its impact and continue investing in new ideas and markets. High Impact's full range of portfolio analytics provide the insights and tools you need to understand and strengthen your portfolio.

|

Understand the drivers of portfolio performance

Evaluate risk drivers, multi-year trends and exposure to macro factors. Portfolio reports are tailored to your organization and focus on the areas that are most relevant to your team, including:

|

|

Faster reporting with automated tools

Portfolio analytics and reporting are critical, but time-consuming components of risk management. Streamline your processes by outsourcing your monthly, quarterly, or annual reporting and allow us to manage data analysis and report generation. Or adopt one of High Impact's reporting tools to automate data aggregation, calculations, and report preparation and spend less time sifting through data and more time planning for the future. Unlike subscription solutions which require you to pay for features you don't need, High Impact works directly with your team to deliver a product that fits your organization. |

Loan level reviews

High Impact will review the performance of existing loans, including compliance with loan covenants and reporting requirements, status of the project, financial condition of the borrower, and overall credit risk. This assessment will result in a recommended risk rating, loan loss reserve, and plan for follow up, if applicable.

High Impact will review the performance of existing loans, including compliance with loan covenants and reporting requirements, status of the project, financial condition of the borrower, and overall credit risk. This assessment will result in a recommended risk rating, loan loss reserve, and plan for follow up, if applicable.

To learn more about High Impact's portfolio analytics and to preview our reporting tools email us at: [email protected]