Simplifying NMTC Unwinds

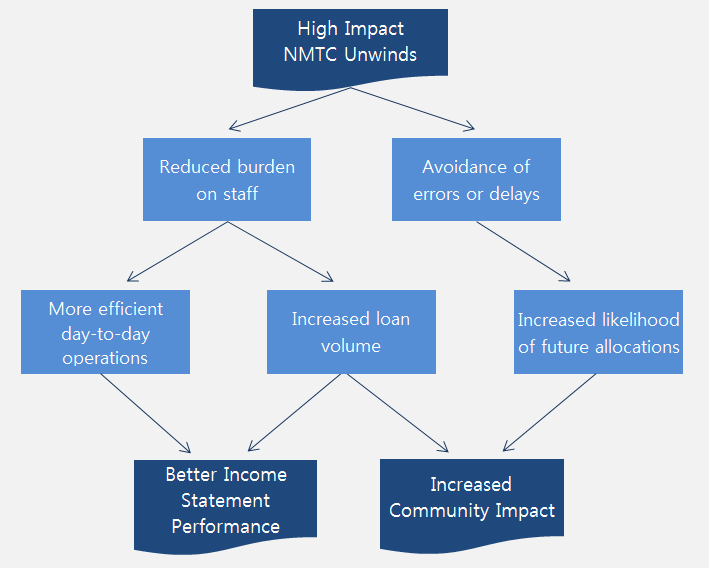

New Markets Tax Credit unwinds can be stressful, time-consuming, and confusing. Trust High Impact to direct you and other deal participants to an uneventful unwind. High Impact manages the mechanics of NMTC unwinds for CDEs. We review closing documents, audits, bank statements, and other documents to compile an Unwind Transaction Guide, a document that governs the cash flows at unwind. We also coordinate with your accounting staff and other parties to the deal to ensure that there will be no surprises on the day of the unwind. In short, we handle the details so that you can focus on the big picture.

|

What does it take to pull off a successful NMTC unwind?

Whether you choose to use High Impact or not, keep these NMTC unwind tips in mind:

|

- ...but don't forget about the big picture. The start of any unwind is at the QALICB level. If the QALICB doesn't have the funding necessary to repay its debt, the mechanics of the unwind are irrelevant. Taking the time to help secure financing for your QALICB, if necessary, should be your primary focus. High Impact can give you more time to tackle that challenge by managing the unwind for you.